Real Estate Funding Services

Why Should You Consider Real Estate Fund or Finance Services?

It’s a tricky yet inevitable question that we should have an answer to even before thinking of jumping into the real estate business at any scale.

- The first and foremost fact is that real estate is growing at a rapid pace- a 30% CAGR. At this rate, you can double your business & increase your profit within an average of 2.5 years. Who doesn’t like it?

- This is the time of low-interest rates. It means you have the opportunity to take a big amount of loans from financial institutes and invest in real estate for high profitability.

- Home finance in India and global level operating at low net NPA level than banks as well. It’s a positive sign for investment in real estate.

- Finally, the high demand for affordable housing remains persists and fueling growth in the real estate market at anticipating rates.

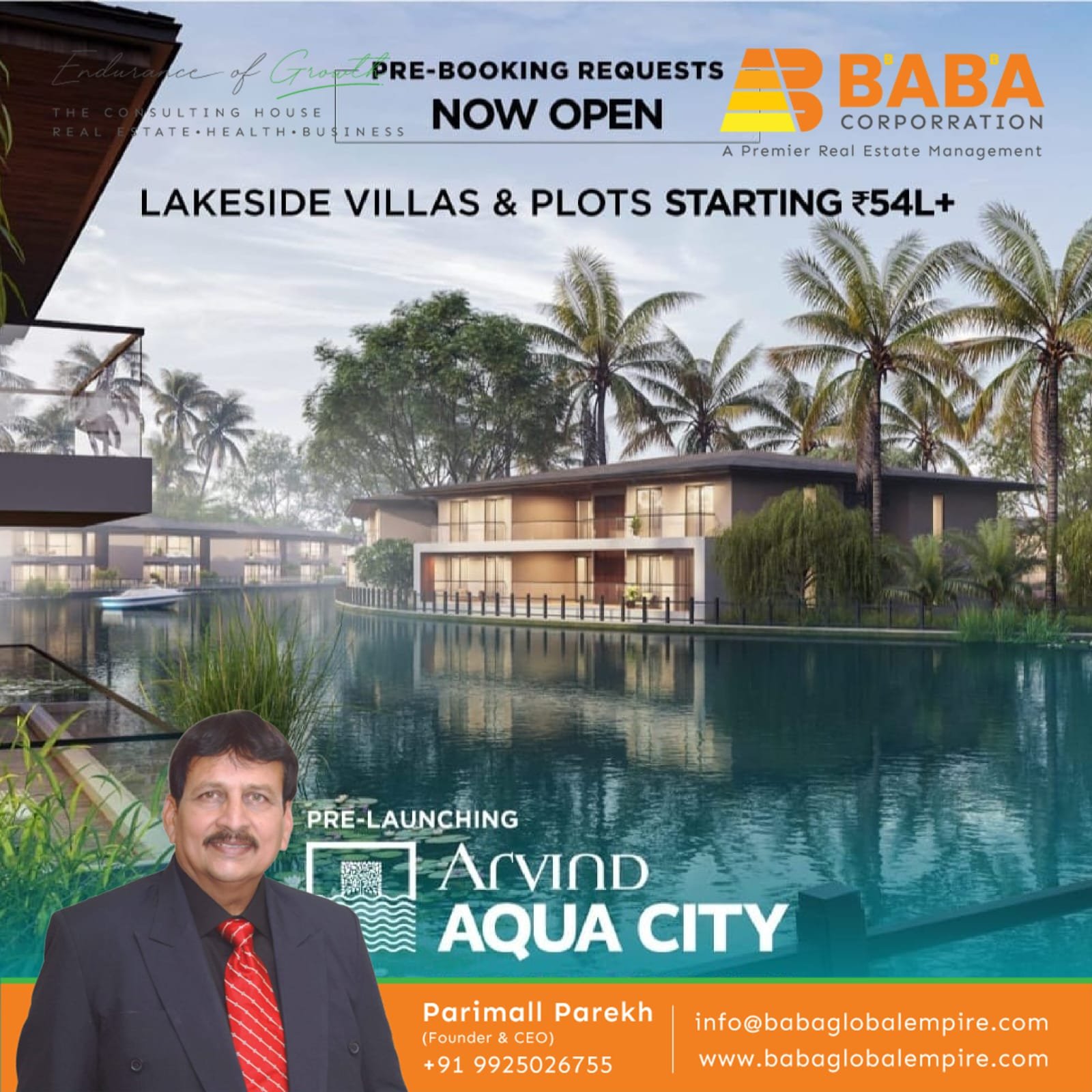

We think these are enough causes to tempt anyone to jump into drawing funding through various valid resources and investing in real estate. In such moments BABA Corporation is a trustworthy name in the market to obtain dependable real estate funding services to turn your ideas into concrete reality.

Sources of Real Estate Funding:

There are multiple sources of real estate funding: primary sources or traditional/conventional sources and modern sources.

Primary sources are:

- Commercial banks

- Mutual saving banks

- Life insurance banks

- Loan and saving associations

Financial middlemen or agencies are secondary choices across the globe and in India. For example:

- Mortgage brokers

- Mortgage bankers

- Finance companies

- Foreign funds

- Fractional real estate investment

- PF or pension funds (Recently allowed)

- Credit unions

- Real estate investment trusts (REIT)

- Investment groups

- individuals

Banks offer three types of loans:

- Conventional Bank Loans

- Hard Money Loans

- Home Equity Loans

Bank loans require one-fifth of the down payment. Repay period is up to 20 years.

Similarly, REIT is a transparent option with SEBI in India. If you want to go that way you can collect funds through the stock market and AIF is a stable option.

Fractional real estate investment is a popular and modern funding option in the USA and European markets. Here, diversification of the portfolio cuts the risks.

Real Estate Funding Services By Baba Corporation

BABA Corporation lets its patrons focus on their main activities by providing support in day-to-day back-office support regarding their real estate funding endeavors,

Fund Administrative Services:

Our focus is on transparency & efficient fund management. We help our patrons in the following areas:

- Regulatory and shareholder reporting services

- Fillings for government bodies services

- Composition of automated reporting services

- Compliance services

- Performance and regulatory reporting services

- Expenditure budgeting and related services

- Global tax services

- Audit oversight services

- Managing regulatory and board meeting tasks services

- Fund compliance services

- General consulting services

Fund Accounting Services:

We offer flexible & scalable real-time accounting services for the following solutions:

- Multi-class funds

- Pooled funds

- Master feeder

- Fund of fund

- Enhanced multi-manager

We also offer a transparent global view across accounting bases, such as:

- GAAP (Generally Accepted Accounting Principles)

- IFRS (International Financial Reporting Standards)

- Local accounting standards and tax logic.

Fund Investor Services:

- Opportunity to work with specialist services.

- We offer real-time data and intelligence throughout the investment life cycle.

- You can make a better-informed investment decision with us.

- You can optimize returns.

- You can streamline business operations.

Fund Performance Measurement Services:

We offer the right tools to get insights into the performance strategy and transparency in performance drivers. Moreover, our performance attribution and measurement services provide you with the following info:

- Daily and monthly performance

- Library of standard indices.

- Configuration option

- Classification hierarchy for investment type

- Top-down, bottom-up, and enhanced options

Fund Treasury Services:

We provide consulting services to meet you with agencies that offer comprehensive depository services to meet AIFMD (Alternative Investment Fund Manager Directives) requirements. It consists of:

- Cash monitoring

- Oversight

- Safekeeping

- Depository lite services

- Primary broker fund services

- Real estate fund services or private equity

Fund Regulatory Support Services:

We offer regulatory and investment analytic services. It includes:

- AIFMD reporting

- Stress testing for money market funds

- Dodd-frank from PF reporting

- UCITS reporting

- Open protocol risk reporting